From a Valuation Point of View - The Swimming Pool Industry

- JSO Valuation, Ltd.,

- Mar 17, 2020

- 17 min read

From a Valuation Point of View -

The Swimming Pool Industry

Historically, in the United Stated, swim clubs appear to have a more common and possibly a mundane start to their existence than one might imagine. It was in many instances, neighbors in the 1960s getting together to finance the purchase and than construction of a pool, to serve their community’s immediate need and those of their families. Northland Swim Club, Ohio (1964), Flourtown Swim, Pennsylvania (1961), Knownton Swim Club, Pennsylvania (1920s), Riverside Swim Club, Illinois (1962), Forest Park Pool, California (1960) are several that had such a community based start. For the most part, these clubs came into existence at a time when the underline real estate (basically the land) was very affordable. Maybe a single tank was cut into the ground and lawn chairs and basic amenities were installed.

Today, given many of these clubs and their locations, they would simply not be able to afford the underlying land let alone install two- to three-pools (tanks) on site. Most have come a long way from their original beginnings in those early years. Cities have also come a long way in stretching out to meet these more peripheral communities of the 1960s to transform them to todays close in suburbs.

The term “club” has been defined as “an organization composed of people who voluntarily meet on a regular basis for a mutual purpose other then educational, religious, charitable, our financial pursuits. A club is any kind of group that has members who meet for a social, literary, or political purpose, such as health clubs, country clubs, book clubs, and women’s associations, dining club, etc. The term club is not a legal term per se, but a group that organizes itself as a club must comply with any laws covering its organization.[1]” But even under that definition, many of these clubs have become quite sophisticated.

The swimming pool industry is a steady mature enterprise that is still growing, be it slowly and is very determinative on the economy. IBIS World defines “this [as an] industry operat[ing] public or private swimming pools, excluding those that are part of affiliated gyms of fitness clubs[2].” The main activities of the industry include collecting annual dues or membership fees, maintaining the swimming pools and its surrounding infrastructure, providing swimming instructions and classes, running ‘for profit’ events, in addition to selling snacks and other concessions including specific club merchandize (spirit-wear). But clearly there are other potential revenue streams too.

The industry in general has experienced growth in the last five-years, due to macro-economic improvements such as increased national productivity. Since a family’s decision to pay membership fees to a swim club is largely discretionary, rising disposable income levels tend to benefit this industry as a whole. This growth extends over private, public and including those that are affiliated to a fitness center. The growth is despite some declining participation rates in parts of the country in swimming activities, in addition to some local government budget difficulties.

In general however, there has been an overall increase in the participation in sports, especially youth sports across the nation. A part of any decline can also be attributed to the graying of America and changing demographics where many of these pools are located. Whether these are in the more affluent suburbs along Philadelphia’s Main-line, or the more middle class older neighborhoods of the south and west Chicago metropolitan suburbs. The rising local and state government spending over the five years to 2019 has also been a benefited to some of the industry’s publicly run establishments such as inner city pools etc.

Eight-years ago continued declining local and state government spending as a result of the Great Recession of 2008-12 had shuttered many publically run establishments. (This date is debatable but the shadow lasted until 2012 before there was a significant uptick due to all the government intervention in 2009) This was seen in budget shortfalls from declining tax revenues. This article is also been written during the initial infection phase of COVID-19 and as to where the country and the economy will proceed in the next six-months is anyone guess. But worldwide, one is bracing for potentially staggering job and productivity losses in every sector.

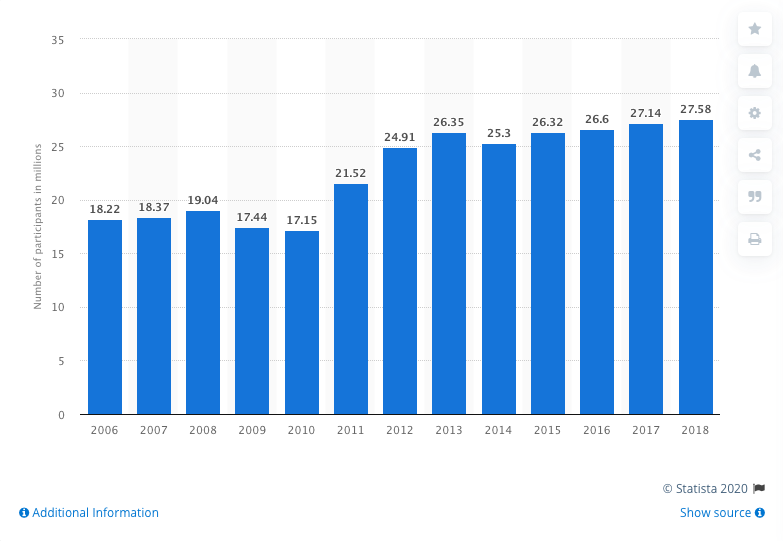

Involvement in swimming had been generally declining overtime. But according to 2017 Outdoor Participation Report[3], between 19% and 21% of all individuals (six- to 12- and 13- to 17-years old) were considered to have participated in swimming activities in 2017. Statista 2020[4], put the total number of participants as showing a significant recovery from the Great Recession with 2018 being the greatest year in almost a decade.

Number of people who do swimming in the United States from 2006 to 2018

In an OpEd Opinion in the New York Times on March 12, 2020 Jennifer L. Etnier, quoting from National Alliance for Youth Sports stated that “over the years there have been numerous studies about youth sports: the benefits of them, which sports are most popular, which sports are growing, etc. One conclusion from these participation studies that always stands out is the dropout rate: about 70% of children quit playing sports by age thirteen[5]. This is relatively important for all the pools that are a part of a club. When the children loose interest the parents can cancel their membership. So when valuing a club, the structure of the membership and more importantly the structure of the immediate demographics should be an important issue to consider.

Looking to the next five years (2024), the industry is projected to have a positive trend (IbisWorld.) Revenue is expected to expand, rising at an annualized rate of 0.9% and the

industry should remain a $1.1-billion dollar activity. While the revenue is up from 2016 ($870.7M) the annual growth

is down two-tenths of one percent (19-24). Profit, wages and the number of businesses are all up from 2016. In the near future, the percent of people participating in sports, exercise, and recreation is also set to rise. There are several key external drivers that are responsible for the increase in the enterprise.

The main factor is the per capita disposable income has been increasing and should continue to do so assuming there is not a sustained hit (possibly recession) to the economy. At the time of writing the markets are currently experiencing turmoil. People up until a month ago have been free to spend money freely on more luxurious activities and club membership falls into that category. Also, there has been an increase in general participation in all sports. The last major external driver propelling the industry is the number of adolescents aged ten to nineteen. Children in the seventeen and younger category make up one third of all swimmers in America.

According to IbisWorld, increasing awareness of our health and the control we have over it including the need for exercise, weight moderation, caloric intake and lifestyle choices among both adults and children has had a positive effect on the swimming pool industry.

The demand for services that are provided by the industry is determined by several factors, including: (1) the per capita disposable income in the immediate local economy, (2) leisure time availability, (3) the age structure of the immediate population (especially those between aged 10- are 19-years old) and finally (4) participation in recreation and sports by not just in youth sports but also adult leagues. Again as we have stated earlier, disposable income availability and how it is spent has a direct impact on this industry. In many of the northern States the annual cycle of swimming pool is short. The season can start in May and by September operations are being wound down for the winter. Therefore capturing that disposable income for those summer months is very important. Family leisure time is always at a premium and incorporating swimming activities into one’s daily routine for some it is close to impossible. However, if the age structure of the community is correct or accommodating, families with children that are 17-years old and younger tend to be members, if swimming is part of their routine. The health benefits are closely link to these decisions about how ones disposable income is spent, the age of the local population and the incorporation of leisure time. In the table above, clearly there is some consistency predicted over the next five-years to 2026. Again it can’t be stressed enough that this is assuming that the current economic situation is short-lived there is no reason to suspect a quick bounce back would or will not occur.

Needless to say there are always counter forces. The potential slowdown of the per capita income/disposable income growth, any decline in local government participation/investment in costs can you clearly have a chilling effect. It is difficult not to look at some comparisons between 2008 and 2020 given the markets financial meltdown, etc. But we also recognize that there is a predictable amount of stability in most communities.

In 2019 alone, the annualized industry revenue rate increased by 0.9%. Along with revenue growth, slight increases in local and state government spending expected to hold steady through 2020.

Geographically swimming pool locations span across the country. Warm weather climates have an advantage since they can be open for longer, which maximizes their operational season. Besides warmer climates, urban areas with a high concentration of people are also successful. People in these areas do not have the space to build private residential pools; this is seen in New York where 7.1% of the industry’s establishments can be found. The Southeast holds 23.3% of establishments and the West comes in at 17%. This is still not very impressive due to the overall populations found in these locations. California by itself has 11.8% of the industry. 18.2% of pools can be found in the Mid-Atlantic (Maryland, Pennsylvania, New Jersey and New York). Again, the absence of space aids the industry along with the shorter operational season that makes it less feasible for individuals to own an in-ground outdoor pool. The overall concentration of the industry is low since it is highly fragmented. The four largest players control less than 5% of the market as a whole. An average company will operate less than two establishments, and the majority of locations will employ less than five workers - many only having one. There are several key success factors that operators must consider. These include easy access for clients and the ability to attract local support and patronage. They also need a level of competition existing in the market and provisions of appropriate facilities.

As we alluded to earlier, pools and clubs have various products and services that go along with the business. The largest portion of revenue is in the pool admissions at 36.8% of total revenue. This is unchanged since 2016. These fees are used to cover operational costs, lifeguards, and mortgage/rent/utility payments. Closely behind is the revenue from swim instruction and classes. This accounts for 33.3% of annual income (also unchanged). Swimming lessons and especially now classes such as water aerobics are increasingly popular with the older demographic. Snacks and concessions bring in 29.9% of revenue. What is one of the more interesting results over the four-years is how close it is to a third, a third and a third. Interesting is the unchanged nature of the revenue source of which some might argue stability. Not so sure about that in all cases. Some of the demands that now positively affect the swimming pool industry more than ever stem from an increase in awareness of the need to 1) exercise, 2) weight control, 3) good nutrition, and finally 4) healthy lifestyles. Here we have the older community taking advantage of the need for low impact exercise. However, in the past the revenue component was never a motivator of sorts. This is an area that may not be fully monetized and from a valuation point of view this is not perfect. Missed opportunities one might say. Where there is one there maybe others.

The swim clubs were originally organized around the community, and the profit motivation was never a serious across the board, influence. They were run very much like a cooperative living where all revenue sources covered all anticipated costs (plus a fund for reserves.) There was in many instances not a perceived need for a Reserve for Replacement of the very expensive capital items such as the tanks and the all-important underground piping, etc. However, this sinking fund or reserve fund needs capital and that capital in many instances to come from different sources within the club. At this stage we have not even begun to talk about these for profit facilitates that pay real estate taxes. This is not an topic for this paper, but in some communities it is a very significant expense. In the 1960, land was inexpensive, housing was sparse and the tax revenues were not stretched past breaking point. Paying for schools, infrastructure, past bond issues, the library, park district, etc. was never a concern. Clearly there are a lot of fingers in the local tax pie that were not present all those decades ago. Taxes and real estate is really another topic, and frankly to big for this paper. As a valuer, this is a fixed cost that should not be glanced over. In many instances all or a portion of the club can be exempt or the land is treated as open space. This expense item needs close consideration.

The revenue items outlined above were Admissions followed by Swim Classes and than the Concession Stand. There was no “Other Category.” This will need to be expanded if many of these clubs are to survive for future decades without the burden of special assessments.

Adding to the list has to be:

Non-refundable Initiation fees.

Swim meets/water polo/diving.

Food.

On site nutritionist.

Senior Activity Classes and associated clubs.

July 4th celebrations.

Opening day/closing day celebrations/party.

Private functions.

Bar activities.

Special nighttime entertainment.

Rentals - towel, blanket, chairs, etc.

Corporate sponsors.

Bench Sponsors to name a few.

Most of these functions do not need any explanation. However, as property valuers and consultants we do like to see a robust allocation of funds possibly as much as 10% and 15% of gross revenue generated from non-pool activities. For example, naming rights are important, but seeing certain parts of the complex with additional names is prudent especially in exchange for the direct funding of the cost of the rehabilitation of certain areas that will go on to generate more revenue. The nominal cost of renting deck chairs, etc. can offset their initial cost and maintain this amenity at the highest level. It can be self-sustaining. Bands, plays, children’s after-dark nights are all sources of revenue. The sale of alcohol and its mark-up allows an adult grounding where the entire family maybe more willing participants in the club. This also circles (hard to stress its importance) around to available per capita income and the all important leisure time. Pools/Clubs need to be very inclusive to all the different age groups and yet while serving alcohol is an important consideration there is also safety issues and insurance.

Specialty parties such as the 4th of July, Memorial Day, etc. are yet another source of revenue. Many clubs pay for one party, but this is offset by other community events.

There is a need to recognize that the founders of many of these swim clubs are the seniors of today. Activities, a nutritionist, etc. are important way to maintain their participation in the organization. More and more seniors recognize that swimming and its low impact activity is an excellent way to stay healthy. Tailoring morning classes to the senior community has many benefits from membership to a more family cohesive atmosphere where grandchildren become part of the swimming community.

The concession stand/store and food is critical to any operation. The gas grill set-up with the lifeguard manning the hot-dogs is not if possible the way to go. (Clearly, there are potential space limitations that confine the club in many ways.) If possible a more robust and inclusive menu is needed. This also fits into a family’s monthly-required allocation (many times this allocation is a non-starter). There is also a need for “spirit-wear” and the sales of hoodies to bathing suites with the clubs logo emblazed. In many parts of the country these are not all-year round clubs. In Illinois, there is always a need to know well in advance what are all the revenue services and their individual departmental costs. The season is so short and many bills to pay.

The main revenue sources are the annual dues. These can vary greatly in the different competitive sets. Within these sets there are tennis clubs, social memberships to golf clubs, etc. However, there is a need to know ones competitive set and their various charges. Being at the top (from a cost of membership point of view) may discourage membership and being at the bottom is leaving money on the table. One has to establish is a single Pump-Pay Family Membership the primary option, or is the membership scales to the numbers within the family (ie. One, two, three of more kids), should there be an AuPair/Nanny Pass, Senior Membership and Empty Nester Membership. These are all important as one needs to keep in mind the usage and capacity.

When there is a waiting list dues are more palatable. When there is no waiting list, are the facilities being maintained to their maximum or are these maintenance costs simply to high. Dues should always be non-refundable and if there is a family drop out (a move, change in circumstance, etc.) these dues should go directly to the capital improvement account to be used at a later date. Especially if there is a cap on membership and a new family is coming in paying a new set of dues.

So far we have looked at the economics of the swim club industry, the actual and potential revenue sources, so from a valuation point of view where do we start and what questions do we need answered regarding the asset. Starting with a list - not comprehensive but a start, these maybe some of the kick off questions for the board as the appraisal in commencing:

The length and width of the large tank?

The Age of all the pools?

The depth of the pools and their gallon capacity?

Do you use your diving well (assuming that there is one)?

What are the annual water loss and how much added water (over evaporation) is needed to keep the pools at the correct water level? (What are the final average water annual consumption usage and its cost.)

If there is water loss, what is the added cost of the supplementary chemicals needed to maintain the integrity of the water quality?

How old are the mechanical systems and are parts still available?

Areas around the pool – are these non-slip tiles/surface?

The age of the bathhouse and what are its amenities?

The total individual sources of revenue? (Membership Initiation fees (non-refundable), membership fees – annual and on a sliding scale, concessions (minimum family/household amount), swim lessons, swim meets, July 4th celebrations, opening day/closing day celebrations, private parties, the bar area, special nighttime entertainment, towel, blanket, chair - rentals, corporate sponsors, nutritionist, etc.

The last time the concession area was updated.

How many SKUs (shop keeping units) are carried?

What is the profit margin on the concession areas? One has to assume that there is more then one. A main area and then carts strategically placed.

Do all the members charge the purchase to their accounts? In this instance cash is not king!

Do you use Apple Pay or other proprietary app for payment or an account charge slip?

The age of the eating area and the last time that this section was updated?

Do you shrink-wrap all the items that cannot fit in the bathhouse for winterization?

Any multipurpose recreational areas?

Tennis courts, racquet/paddle ball, etc. Is there room to add these features. Super strong attraction for men.

Any plans for a complete over-haul of the facility or parts?

Outside play areas and their management? ie. Are they utilized

The energy efficiency of the water-heating units?

Days of operation on an annual basis. Why do you close?

Could the tanks be frozen over?

Could the acreage be used for the different purpose in the winter? Paddle Ball, ice hockey, cross-country or steeplechase running, cross-country skiing, etc.?

Why not “year-round” operation?

Do you have a wait-list?

Do you draw from outside the community?

Has the club falling out of any code violations that should be remediated if any work was to be done other areas of property (ADA 2010)?

The site visit is complete, details and ages are known, photos are in the camera, including is possible drone photos. Now what?

It is back to the Scope of the Assignment. What is the purpose of the appraisal or the analysis? Insurance? Financing for new capital items? Real Estate Tax Appeal? Asset Management, etc. Each use may have different approaches to value.

The Cost Approach to Value is a must in my opinion. It has three primary purposes as well are other benefits.

1. The value of the underlying land is known.

2. The depreciated value of the existing improvements is developed. An estimate of potential functional obsolescence, physical deterioration and external obsolescence. Careful not to double count.

3. The lump sum difference in depreciation from all sources (The cost to build is known, and its value from another approach is also known.) can be extrapolated. This maybe an important test as to the reasonableness of the Cost Approach to value in general.

There are many downsides to this approach, namely, the age of the structures. It is very hard to estimate depreciation accurately. But on the flip side of that coin one can develop a list of incurable functional obsolescence and both curable (not to be underestimated this is quite hard) and incurable physical deterioration. If nothing else one is painting a more whole picture as to what was observed.

What about an Income Approach to Value? This is back to the Scope of the Assignment. Many maybe even most of this property class typically does not rent. Therefore one is looking at three-years of revenue and operating statements. But these may not be helpful for many reasons. If the club is run on a breakeven (plus reserves) basis. Poor recent financial performance with little or no residual net operating income, etc. This could well be the reason you are on site. The potential need to separate the real estate from the business valuation. It can become tricky and expensive. Than again, past performance and the future operation may yield very substantial differences, especially from a value point of view. Is the revenue maximized, are the fixed costs under control. The major one here is clearly real estate taxes, but also insurance. The variable costs may need special care in their analysis. In a line or two ideas as to where to look are not possible to articulate. But common sense is a strong component here. Below there is a breakdown of the expected expenses in this industry.

The cost structure is fairly simple in the swimming pool industry. In the next five years, profits are expected to decrease slightly from 13.5% in 2014 to 13% in 2019. Of course, this is dependent on the enterprise type and size. Wages make up the largest cost representing 34.2% of total revenue in 2019. This was up slightly from 2014 where this line item was 33.6%. In order to minimize these expenses, more part-time hourly workers are being hired. The table above is an excellent comparative start when analyzing property expenses. But there is a cautionary tale here, and that is different locations will have different cost structures.

Purchases also is a small outflow, yet, in 2019 it accounted for 5.9%, representing a slight increase from 2014 of 5.8%.

Given the relatively small employment footprint, the swimming pools industry is moderately capital intensive. Consequently, depreciation represents a large expense for swimming pools at around 7% in 2019. Equipment such as safety vacuum release systems, pumps, filters, and diving boards are the items that depreciate the most.

Utilities are another large portion of swimming pool expenses. As it is the nature of the industry, water constitutes a substantial component of the cost structure. In 2019, rent and utilities accounted for 3.3% of industry’s revenue this was up slightly from 2014 (3.2%). Although there are obvious seasonal fluctuations, the annual trends are very steady.

There are two main channels that accumulate into the high competition that makes up the swimming pool industry. Internal competition is seen amongst other swimming pools and tends to focus around facilities and membership or admission fees. The other channel competition comes from is external.

Finally there is the Sales Comparison Approach to Value. There are some national sales and indeed the very random local sale. But these are more difficult to analyze. Does the per capita or the family household income lineup, is there a significant difference in the underlying land value. Are the annual membership dues similar? Where these sales sold as a redevelopment site or as a going concern? There are many more comparisons to be made. But regardless one can see a pattern developing. It will not be prefect, but it is a legitimate indicator of value. My opinion just let the reader understand how the data is being treated. In any appraisal, the reader does not have to agree with you just understand how your value was developed. The greater the understanding of the report the closer is the agreement to value.

Natural geographic locations such as lake and ocean fronts serve as an alternative to paying to use a pool. Or some people look to get more with their money by spending it on amusement parks that have a water aspect built in. The largest source of external competition is from gyms, health, and fitness clubs. These offer a wider range of activities, locations, and a more flexible age range. With all of these sources of competition, there is still a low and steady trend for the barrier of entry. The most significant step is access to capital to purchase the land and construct a swimming pool. There are no players that dominate the industry, since it is mostly composed of local publicly and privately owned companies with usually only one location. Industry assistance is low but found with swimming pools. As healthier habits are more popularized, assistance has been increasing.

Overall, the swimming pool industry is a steadily growing, even with the potential setbacks of government budgets and dips in participation and interest. There is versatility in where the industry can succeed seeing as there are increased concentrations on both coasts in two different climates. More available disposal income and overall macroeconomic improvements have also supported the industry.

About the Author

John O'Dwyer is the president of JSO Valuation Group, Limited. This is a national appraisal firm located in Evanston Illinois. JSO specializes in valuations of low-income limited-equity cooperative housing, self storage warehouses, community or club swimming pools, convenience stores along with the traditional commercial buildings such as offices, retail and industrial properties. The firm has an emphasis on property taxes appraisals, estate valuation and insurance valuations. In addition to position papers on the commercial swimming pool industry, Mr. O'Dwyer has also written on the automobile industry, convenience stores with gas stations, death industry, automobile dealerships, to mention a few.

[1] Legal-dictionary.thefreedictionary.com/Private clubs [2] Ibis World Industry Report OD5715, Swimming Pools in the US, October 2016, Taylor Palmer [3] https://outdoorindustry.org/wp-content/uploads/2017/05/2017-Outdoor-Recreation-Participation-Report_FINAL.pdf [4] https://www.statista.com/statistics/191621/participants-in-swimming-in-the-us-since-2006/ [5] https://www.nays.org/blog/would-you-let-your-child-quit-a-sport-mid-season

Comments