News feed - Hotel sector

CMBS Newsflash: Modification and Foreclosure Pipeline – More Retail and Lodging Foreclosures to Come?

AN ANALYSIS BY DAVID SALZ & THOMAS LASALVIA JUNE 15, 2021 Moody's Analytics

The anticipated flood of retail and lodging property foreclosures due to the pandemic has so far been more of a trickle. In May, just 12 loans representing about $270 million of outstanding balance were marked as officially beginning the foreclosure process, while 13 loans totaling about $180 million were in REO. In both cases, predictably, retail and lodging comprised most of the affected loans. Yet the rate at which loans are moving into foreclosure and REO has fallen short of the levels many feared would be reached 14 months after the pandemic’s onset in the U.S.

Meanwhile, the rate at which retail and lodging loans are being modified has also slowed significantly. As shown in the graph below, the balance of retail and lodging loans modified (based on the “Date of Last Modification” as reported by trustees) reached a peak early last summer before declining in the fall. There was then a temporary spike in the rate of modifications in December, but that gave way to a sharp drop early this year.

One caveat to the figures above is that we typically see a lag between when a loan is modified and when the trustee reports the modification. This lag is typically 30-90 days, but occasionally it can be longer. Nonetheless, we can be confident that the decline in new modifications in January and February is real, although the figures for March through May might change. This decline in the rate of new modifications may indicate that special servicers are finding that modifications may not be sufficient to cure the remaining troubled loans. In those cases, special servicers may opt for foreclosures.

While foreclosures on retail and lodging properties have been limited so far, CMBS servicer commentaries indicate that there is a significant pipeline of properties that may go through foreclosure. In May, over $6 billion worth of retail and lodging loans had servicer comments mentioning foreclosure, deed-in-lieu, or REO despite not currently being marked as in foreclosure or REO. Of this, about $3.6 billion were retail loans while the other $2.4 billion were lodging loans. These figures clearly dwarf the $450 million of loans that were newly foreclosed or moved to REO in May. Breaking down the $6 billion further, we found that about $2.3 billion had comments indicating a deed in lieu or that the servicer would pursue a dual track modification and foreclosure. Slightly more than half of the $2.3 billion pointed towards the dual track. The remaining $3.7 billion had comments signaling that the properties were set up to follow a traditional foreclosure track.

Looking at regional concentrations of retail and lodging properties heading towards a traditional foreclosure, those are concentrated in the Northeast, as shown below. The Sun Belt and the West, on the other hand, have a brighter outlook.

Distressed Property Sales Are Here. And, No Surprise, They’re Hotels.

Even As Market Enters Recovery Period, Volume Is Expected To Rise

By Mark Heschmeyer April 15, 2021 CoStar News

The hotel industry, crippled by serious blows during the COVID-19 pandemic, is now seeing buyers flock to distressed properties. Sales have surged, according to CoStar data, a clear signal some commercial real estate investors are ready to act while others may still be waiting for similar action in other sectors such as office or retail.

Distressed hotel sales made up 17.5% of all hotel sales in the first quarter. That is up from 0.9% in the fourth quarter of 2019. By comparison, distressed sales overall made up just 1.5% of sales through most of the first quarter — that’s even lower than the five-year average of 1.8%, CoStar shows.

According to buyers and brokers, the number of distressed hotel properties available is likely to grow as owners report financial struggles after a year of dealing with reduced income and deferred maintenance because of the pandemic. Unwanted properties are also expected to come to market.

“We’ve always thought that with the passage of time, the number of hotels that would go into distress would rise, only because these are operating businesses,” Kevin Davis, senior managing director of capital markets for real estate firm JLL’s hospitality group, told CoStar in an interview.

“Notwithstanding the fact that the fundamentals are improving at the properties, it’s still going to take some time for a lot of hotel assets to get to a place where they’re actually covering their operating costs, and also covering debt service.”

Ramping up its efforts, Davis’ team is actively engaged on more than $2 billion in financing assignments.

“The increased liquidity and lower cost of debt capital should be a strong catalyst in the recovery of hotel asset values and should drive significant hotel sales activity,” Davis said.

How long the window stays open for the availability of favorably priced opportunities depends a lot on whether the hotel market stays bearish or moves into a bull phase. Jan Freitag, national director of U.S. hospitality analytics at CoStar Group, laid out the case for each last week.

While hotels appear poised for recovery, a lot of things could still go wrong this fall, such as a new wave of coronavirus infections, too few hotel workers and patrons vaccinated, a glut of supply and continued reduced business travel, Freitag noted.

Distressed hotel property sales rose sharply in the fourth quarter of last year to $396 million, more than three times the amount in the fourth quarter of 2019 — the last full quarter before any impact from the pandemic, according to CoStar data. The volume has gone even higher in the first three months of this year to $506 million — even before final quarterly tallies.

Such significant increases are the exception to what has been a low overall volume of distressed property sales, which are tracked by CoStar under conditions including auctions, bankruptcies, short sales, lender-owned, foreclosures and deed-in-lieu foreclosures.

Distressed sales made up just 1.5% of sales through most of the first quarter — that’s even lower than the five-year average of 1.8%, CoStar shows. However, distressed hotel sales have already made up 17.5% of all hotel sales in the first quarter. That is up from 0.9% in the fourth quarter of 2019.

Distressed property funds have been among the most active buyers and lenders in deals thus far, Davis said, but added that banks and life insurers have been in on deals as well.

Among the firms with active distressed funds is New York-based Monarch Alternative Capital. Fundraising for the oversubscribed fund Monarch Capital Partners V hit $3 billion in December.

Monarch has been busy putting that capital to work, primarily so far on deals it is sourcing through bankruptcy reorganizations.

The firm is scheduled to close next month on the acquisition of the 400-room Crowne Plaza Orlando Universal Boulevard. The hotel was auctioned by Universal Towers Construction through a Section 363 sale process as part of the debtor’s Chapter 11 restructuring.

Monarch is also the stalking horse bidder in a bankruptcy case filed by Singapore-based operator Eagle Hospitality Trust that owns a prominent 18-hotel U.S. portfolio. Monarch has bid $470 million for the portfolio valued at $1.27 billion.

Hospitality isn’t the only property type Monarch is watching closely, Ian Glastein, managing principal at the firm, told CoStar. Investment opportunities are rising in office, retail and healthcare as well and will be for a while.

Right now, the increasing supply is most noticeable in hotels for three reasons, he said.

“After a year of carrying the assets and to the extent that COVID continues through this year, there will be continued liquidity issues of these assets, which may trigger bankruptcies,” Glastein said. “And then, even if there’s not an issue on the debt side, there are partnerships that are invested in assets together. COVID impacted and damaged a lot of relationships between equity partners, and that is precipitating sales as well.”

Monarch’s pending Crown Plaza buy is an example of the latter, he said.

“And then last, I’d say, large hotel assets in general, haven’t been invested in for the past year, as owners tried to divert cash flow to paying debt service, or to just paying negative cash flow,” Glastein said. “As assets come out of COVID and they need to become competitive again, a lot of hotel owners are deciding it may not be worth the capex. Let me just sell.”

“How long the window stays open for favorable pricing really depends I think on the cadence of the recovery,” Glastein said.

Auctions Test Market

Distressed player Cerberus Capital Management is among those testing the current market for pricing. Cerberus completed fundraising last month for its flagship global distressed real estate strategy fund, Cerberus Institutional Real Estate Partners V, pulling in $2.8 billion.

Among the fund’s first investments was teaming up with Highgate Hotels on the purchase of 197 hotels totaling 22,676 rooms in Texas, Louisiana and Oklahoma.

Last week, Cerberus and Highgate had seven of those hotels up for auction individually on CoStar’s Ten-X auction platform.

The properties are part of a commercial mortgage-backed securities loan that missed a maturity payoff in 2017 and has since been extended twice, the latest through August, according to CMBS market data collected by CoStar. Three of the properties were experiencing negative cash flow.

Highgate declined to comment, and Cerberus did not respond to inquiries from CoStar News.

Multiple bids have been placed on each of the seven properties going into their bidding deadlines. The bids averaged 35% of their last appraised values.

Kami Burnette, managing director for Paramount Lodging Advisors, said the auctions are part of a larger set of more than 100 her firm is handling for Cerberus and Highgate.

Financial Pain, Loans Due

Other assets could be hitting the market too, as two publicly traded hotel real estate investment trusts have reported financial struggles.

Hospitality Investors Trust said it is engaged in ongoing discussions with its largest investor, Brookfield Strategic Real Estate Partners II Hospitality REIT II, concerning the possibility of entering into a restructuring transaction that would include, among other things, filing a pre-packaged Chapter 11 bankruptcy in Delaware.

Separately, publicly traded Condor Hospitality Trust cited in its annual report “going concerns” about its ability to continue. Going concern notices are required if a company doesn’t believe it currently has the financial capability to make it through the next 12 months. Condor currently owns 15 hotels in eight states.

In addition, a big bucket of maturing CMBS hotel loans is coming due in November and December. About $4.5 billion in such loans mature, according to data from bond rating agency DBRS Morningstar. Of that amount, just about 52% is listed as currently performing loans.

That leaves many CMBS loans at a heightened risk of default, and according to Moody’s Investors Service, struggling hotels are getting little benefit from the latest round of Paycheck Protection Program money from the federal government. While the additional funds may provide some temporary relief as hotels navigate the fallout from the pandemic, cash flow will remain under pressure, Moody’s said.

“Our analysis shows that the second round of PPP funds will provide on average about two months of hotel loan payments, whereas most will require nine to 12 months of support to return to breakeven profitability,” Kevin Fagan, a Moody’s vice president and senior credit officer, said in a report.

Hotels Break Another Pandemic Record, Fewer Mortgages Refinanced, State Personal Income Declines

What You Need to Know to Start Your Day

By Richard Lawson March 2021 CoStar News

JSO Comments

This need to be carefully dissected as there is just a little bit irrational exuberance tied this posting by CoStar.

The average occupancy was 58.9% (and it does not say it but I am assuming that is the national occupancy). Florida and Texas leading the charge. There has been uniform criticism of the Governors of these two States especially when the number of vaccinations is rapidly increasing. There is a still sadly a Red and Blue mentality. The occupancy rates in the north of the country are very different but CoStar neglected to mention this.

It may be missed but missing was the business traveler. This just happens to be the bread and butter if the hotel industry. Hemme!

On March, 24, 2021, 1,164,954 people passed through TSA lines. This was down from 2,151,913 same date in 2019. This is close to a 1M person drop!

These are the little details that drive me nuts that with words skew the truth on the ground.

Hotels Break Another Pandemic Record

U.S. hotels broke a pandemic occupancy record for the second straight week now that spring break season is in full force, to the chagrin of public health experts who have been pleading for people to stay put.

Occupancy averaged 58.9% for the week that ended March 20, according to data from hotel research firm STR, which is owned by CoStar Group. That beat the prior week’s 52.1% occupancy, the highest recorded average during the pandemic.

“It’s still very much the leisure travelers on the weekend driving demand,” said Kelsey Fenerty, a senior analyst with STR.

STR data shows that weekend occupancy averaged 71.7%, fed in part by higher air travel. More than 1 million travelers passed through airport checkpoints for 13 consecutive days as of Tuesday, according to Transportation Security Administration data. Last Friday was the biggest day, with nearly 1.5 million.

Florida cities and regions continue to dominate for hotels. The Florida Keys and Sarasota actually exceeded 2019 occupancy levels last week with above 90% occupancy.

Tampa once again had the highest occupancy among the 25 largest tourism markets tracked by STR with 85.28%, followed by Miami at 80.69%.

Spring breakers drove occupancy at beach destinations, even as federal health officials have urged even those who have had the coronavirus vaccine to observe social distancing and limit travel. Florida also is in the middle of Major League Baseball spring training season. The Tampa area, for example, is home to training camps for the New York Yankees and the Philadelphia Phillies.

In Texas, hotels surpassed 2019 occupancy levels with 71.62%. McAllen in South Texas near the border with Mexico led the state with 86.4%. Hotels were full partly because of beach visitors but also because of federal government personnel dealing with what Gov. Greg Abbott calls a humanitarian crisis with unaccompanied minors crossing the border.

Fewer Mortgages Being Refinanced

With mortgage rates rising, the number of homeowners refinancing loans dropped last week, but new applications rose.

The Mortgage Bankers Association reported that its composite index declined 2.5% because the refinance index decreased 5%. The purchase index rose 3%, increasing for the fourth consecutive week, and was 26% higher than last year’s pace.

"The 30-year fixed mortgage rate increased to 3.36 percent last week and has now risen 50 basis points since the beginning of the year, in turn shutting off refinance incentives for many borrowers,” said Joel Kan, the association’s associate vice president of economic and industry forecasting. New applications were “driven both by households seeking more living space and younger households looking to enter homeownership.”

State Personal Income Declines

Total personal income across the country declined in the fourth quarter at a smaller rate than the previous quarter, in part because federal benefits related to coronavirus aid expired.

The Commerce Department reported that income fell 6.8% in the quarter after sliding 11.3% in the third quarter.

According to the report Wednesday, higher earnings and property income were offset by a decrease in transfer receipts, which includes government benefits such as unemployment.

South Dakota, however, saw a 16.7% increase. Rhode Island and Pennsylvania saw the largest dip, at 16.1% each.

Personal income rose in 2020 by 6.1%, primarily because of $1.1 trillion in transfer receipts, the result of federal aid through the Coronavirus Aid, Relief, and Economic Security Act that included direct payments, and extra unemployment money on top of the regular weekly benefits.

Life After COVID-19: How Hotels Can Prepare for the Future

By Andy Romjue January 7, 2021 Hotel Business

It’s no secret that the COVID-19 crisis has shocked the hospitality industry. The devastating impact has left hotels in major cities across the country struggling to stay in business, with over half of them below the threshold at which most hotels can break even and pay back debt, according to the American Hotel & Lodging Association (AHLA).

While the hospitality industry continues to struggle with almost two-thirds of hotels at or below 50% occupancy, according to AHLA, and hoteliers grow concerned about the outcome of this new year travel, it’s wise for hotels to apply lessons learned from this year and prepare for the future of the industry beyond COVID-19. Now that safety and cleanliness are more important than ever, it’s time to adapt and reinvent the way hotels attract patrons.

Overcommunicate Cleanliness

According to a survey from AHLA, 81% of travelers feel more comfortable staying at hotels with cleaning and safety protocols that keep everyone safe. In 2021, getting the word out that your hotel is safe and clean is imperative. After implementing improved sanitation practices that help to protect guests from bacteria and viruses, share the news. This can be communicated by outfitting your staff with masks and gloves and creating transparent barriers on front desks, valet tables, etc. Other ways to demonstrate your safety protocols could be hanging signage marking improved cleaning practices and social distancing, preparing sanitizing stations and providing temperature checks upon arrival.

The pandemic has changed people’s awareness of cleanliness and made individuals think again about shaking someone’s hand or sitting at a table they don’t know has been properly wiped down. Hotels working to take every precaution to protect travelers from COVID-19 also helps ensure their guests are protected from other contaminants like bacteria as well. The most common bacteria found in hotels are Salmonella, E. Coli and Legionella, which can make guests sick and affect return visits and loyalty. Making sure your staff is aware of all types of contaminants ranging from bacteria to viruses and are actively working to keep spaces sanitary are especially important for a rebound in 2021.

Conveniences

Even before COVID-19, cleanliness was at the top of the list for guests. In fact, according to a survey from Hotels.com, cleanliness and comfort were rated 36 times more important than a lavish breakfast, pool or deluxe coffee machine.

Another thing that’s at the top of that list? Convenience. Patrons are looking for establishments that offer in-house amenities like coffee shops, multiple restaurants, room service and even small convenience stores. These accommodations can allow guests to stay put within the property, ultimately creating fewer touchpoints while traveling.

Change it Up

Even though traveling will never stop and face-to-face business meetings won’t completely go away, Reuters predicts the travel industry won’t fully recover from 2020’s plunge for at least four years. The slow rebound will likely be a result of corporations lowering their travel expenses and consumers being more precautious. However, with the help of the vaccine and new product innovations geared to keep guests safe, those who feel more comfortable traveling will—and, hoteliers who invest in more sanitary features and improve cleaning protocols will motivate guests to lodge with you.

For example, aligned with CDC recommendations, hotels can consider switching to disposable products everywhere they can from guestrooms and meeting rooms to restrooms. Bonus if you find and use products with antimicrobial properties since its technology will stop the growth and transmission of bacteria and fungi. Additionally, making a shift from hand dryers to disposable hand towels can provide security in cleanliness as studies find hand dryers are less sanitary, increasing the survival rates of bacteria on the hands and in the air.

As many of us prepare to leave 2020 behind, the lessons from COVID-19 will stick around in the hospitality industry. If hoteliers create and use innovation to market clean and safe stays to leisure and business travelers alike, traveling can soon resume with confidence.

Andy Romjue is the president of Hoffmaster, a supplier of disposable foodservice solutions.

Hotel Operators Gear Up To Manage A Flood Of Bank-Owned Properties

Jarred Schenke January 5, 2021 Bisnow Atlanta

JSO Comments

It is somewhat difficult to understand, but it does seem that there is a significant difference between the 2008-09 recession and how non-performing assets are being treated today. In the last recession there was such an avalanche of nonperforming assets many of which were perfectly okay, but for circumstance of the day and what was going on in the economy. It appears now, that there is an entirely new take on the "liars loan." I am simply not reading a lot of information regarding thanks having to place assets on the non-forming side of their balance sheets. We will keep an eye and this as the market unfolds.

A wave of hotels is expected to be taken over by banks and other lenders in the coming months, and some hospitality industry players are looking to build up management arms in hopes of operating those properties for their new owners.

Highgate Hotels, Chesapeake Hospitality and Hospitality Ventures Management Group are among the firms ramping up hiring in anticipation of an influx of hotel management contracts by banks and CMBS bondholders.

“We're spending time with banks and we're in active dialogue around a number of different opportunities,” Highgate principal Richard Russo said. “We certainly are anticipating that volume to increase.”

Hotel owners have faced an extreme drop in business due to the coronavirus pandemic and various lockdown orders around the world. U.S. hotel occupancy fell from an average of 66% in 2019 to 42% last year, according to STR. (https://str.com/press-release/2020-us-hotel-forecast-slightly-upgraded-full-recovery-still unlikely-until-2024 - See full article below at November 12, 2020) The average revenue per available room — the hotel industry’s leading performance indicator — dropped from $86.67 to $43.76 year-over-year.

There is no V-shaped recovery projected for the hospitality industry as the financial pain for some hotels is expected to deepen in the months ahead. The industry isn’t expected to recover its pre-pandemic demand and revenues until 2024, according to recent predictions from STR and Tourism Economics (https://str.com/press-release/2020-us-hotel-forecastslightly-upgraded-full-recovery-still-unlikely-until 2024). By the end of 2021, the industry could recapture 80% of pre-pandemic demand and 70% of 2019’s RevPAR.

By the end of 2020, at least 19 CMBS loans backed by hotels totaling nearly $495M in value had fallen into foreclosure, according to the credit rating agency DBRS Morningstar. Another 635 loans backed by hotel properties are in special servicing due to the pandemic's impact on their performance. Those troubled loans add up to $18.5B in debt, according to Morningstar.

“I do expect [foreclosures] to get worse,” Chesapeake CEO Chris Green said. “What's coming up, quite frankly, is real estate tax payments. And hotels have been running negative cash flows for six to nine months.” In a foreclosure, the lender takes full ownership of a commercial property when the borrower can't make payments. But at that point, the property is on the books of that financial organization. Typically, banks and other lenders then turn to management companies to operate the properties for them and attempt to turn them around.

The management firms are paid on a percentage of the hotel revenues, and they can collect the extra incentive of a percentage of the revenue growth. Taking over struggling hotels poses a variety of challenges for the new operators, Green said, depending on what drove the hotels into foreclosure.

Companies could rehire staff or spruce up the property. At times, they may come in and rebrand the property. Sometimes the answer to struggling hotels, even during a pandemic, may be improved marketing efforts, Green said. “Listen, people are still traveling,” Green said. "The question is, are you capturing the travelers who are in your market? And how fast will you identify the new travelers as they enter the market?"

But far fewer are traveling than during past recessions because of the pandemic, which threw hotels that were

performing well into sudden distress. Hotel operators will still be at the mercy of the economic recovery, vaccine

distribution and the confidence of people willing to travel again.

“The industry is where it's at because of a pandemic that has absolutely nothing to do with the industry and how people bought hotels and built hotels,” HVMG Executive Vice President Mary Beth Cutshall said. “This isn't an issue about people being overleveraged. This is just a shutdown in demand.”

Hotel management companies already are seeing new business. Peachtree Hotel Group has taken over the management of four hotels for banks since November, CEO Greg Friedman told Bisnow.

Maryland-based Chesapeake’s management division will likely enter into more contracts than it did during the Great Recession, Green said. Chesapeake typically enters into longer-term contracts with banks and lenders to manage and turn around ailing hotel properties in the eastern U.S., including replacing the brands and operators. That growth could prompt Chesapeake to hire more than 500 employees in the coming months, Green said.

“I could see that division doing 15 hotels over the next couple of years,” he said.

In early December, HVMG announced that it was ramping up its lender-owned real estate management division, starting with contracts to operate two foreclosed hotels in Texas. Now, the firm is positioning itself to take on even more management contracts with banks.

Other hotel companies see opportunities to take advantage of distress outside of managing

properties for banks and special servicers. Peachtree Hotel Group has been buying first mortgages at a discount from banks that would rather not take ownership from struggling borrowers. In 2020, Peachtree purchased 50

mortgages from regional and community banks for around $400M combined, Friedman said.

Instead of foreclosing on those properties, Friedman said Peachtree is looking to work with the borrowers to improve operations.

“We expect that over 90% of the loans we acquired will end up getting paid off by the borrower,” he said.

Even though HVMG is ramping up its bank-owned management division, Cutshall said the latest round of stimulus passed by Congress is leading her to moderate her prediction of a large deluge of foreclosures. The package, which includes another round of Paycheck Protection Program payments, may have given banks and special servicers the incentive to delay taking back properties a little while longer.

HVMG executives saw evidence of that recently after the firm was awarded management contracts for a handful of hotels tied up in CMBS loans, Cutshall said. The special servicers have yet to foreclose on the property, which has delayed the start of those contracts, she said.

“[Lenders would] rather work with a good borrower, recognizing the loss of business is not due to poor performance but is because of a pandemic,” she said. “A lot of us are starting to think there will not be an avalanche.”

Hotel Revenues Worsened in October, but the Outlook Is a Bit Better

Five Things to Know About the State of the Hospitality Market

By: Jan Freitag November 25, 2020 CoStar News

1. Revenue Declines a Bit Worse

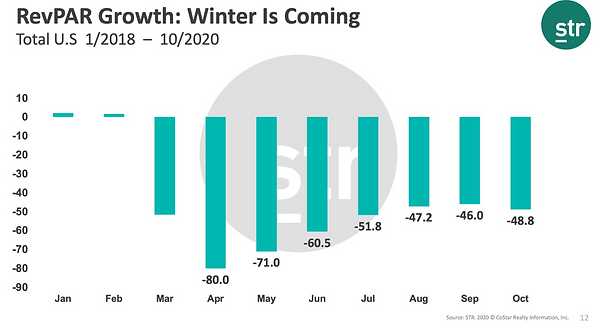

October revenue per available room declined 48.8%, and a “better than -50%” performance was expected, but it is little comfort to see the key performance measure turn down than September data. I guess my thinking was the performance was already so depressed, each month should at least show a minimal improvement — just like we saw between September and August. Alas, it was not meant to be:

The reason for this was likely the disappearance in leisure travelers who, while still taking advantage of summer days and rates after Labor Day, eventually returned home. Combine this with continued lack of business travel because offices are still empty and the outcome is that the results are slipping. And there really is no improvement on the horizon.

2. Cognitive Dissonance

In psychology, cognitive dissonance is the mental stress or discomfort experienced by an individual who holds two or more contradictory beliefs, ideas, or values at the same time.

The two figures that could cause said condition are “1 million” and “+10%.” The following chart should strike fear into the hearts of hoteliers, lenders, and destination marketing organizations across the land — since it likely has impacted the traveler psyche already. In the week ending Nov. 14 the U.S. registered 1 million new COVID-19 cases.

Given this, it is no wonder that when Ugur Sahin announced from his company BioNTech’s headquarters in Mainz, Germany, that its COVID vaccine was 95% effective the stock market analyst community lost its collective mind (in a good way). Analysts basically conjectured that this meant that the virus is over and done with and that travelers will be back in hotel lobbies and hotels will make money again. That at least is what you must infer when you read the stock market reaction, especially in the lodging stocks, on Nov. 16. The average increase was around 10%.

So, yes, an effective vaccine is of course great news, but it will be a while until it is accessible to the individual traveler. Until then, will we see 1 million more infections, and corresponding deaths, per week, for weeks on end this winter — keeping people at home longer still? That question likely caused the stock rally to be short-lived and a week later most of the increase had dissipated.

“Buy the rumor, sell the facts” is the old stock market adage that seems to have been at play here.

3. New STR Forecast

At the virtual NYU conference STR's CEO Amanda Hite presented the latest forecast. The good news is that the forecast got a tiny bit better for 2020. Leisure travel was a little bit stronger than we had expected at our last go-around in August, so we now expect that this year’s RevPAR decline is (slightly) better than -50%.

Our 2021 outlook has not changed much and next year will be written about as the year with the single best RevPAR increase ever. Despite the vaccine news (see above) we did not change our conviction for next year simply because our friends from Tourism Economics, Adam Sacks and Aran Ryan, two of the smartest guys in any room, had already “baked in” news of this sort when we discussed our earlier forecasts. In other words, they always knew that this news would come, they did not know when or through whom, but it was expected and therefore considered.

Despite the corresponding increase in demand, we continue to forecast underwhelming average daily rate increases next year and in the coming years for that matter. It’s hard to see a catalyst for strong pricing power when basically half the rooms in the U.S. stand empty.

4. Segmentation Data

The third time is quite charming indeed and in October the number of group rooms sold topped 1 million again for the third month in a row. It is still hard to fathom any big multinational corporation flying its sales team to a weeklong product kickoff event at a downtown high-rise hotel, so the assumption remains that SMERF (Social, Military, Education, Religious and Fraternal) groups make up a large portion of the count.

In addition, association events also must take place to fund the association’s ongoing business. And there are, of course, some smaller corporations that make meetings happen. But I would think those are few and far between.

Unfortunately, the group rooms sold equate to an actual occupancy of 5% (Five!). RevPAR change in the group space has not moved much from the 90% decline earlier in the year and nothing suggests that the data will get meaningfully better this year or in early 2021. Here are the October results in detail:

5. In-Construction Pipeline

Just like in prior months, the number of U.S. hotel rooms in construction is skewed toward limited service with seven in 10 rooms being built at the lower price point. You might be thinking, “Jan, you say this every month, it’s boring.” Well, here is a slightly different way of looking at that data set: Let’s compare the rooms coming online to the total stock by class and this picture emerges:

Looks like the small count of 13,300 luxury rooms is actually 12% of the existing luxury inventory, so that new supply will matter to future performance. Now, these are weird times (and that is an understatement!) and more than 10% of all luxury rooms are still temporarily closed, hence the “percent of existing” count is likely overstating the reality of the impact.

The way I think about this percent is that I assume the projects at the luxury end take three years to complete. When you do that math in your head, you get a roughly 4% increase per year over the next three years. A year ago, in October 2019, the increase in luxury rooms was around 2.3%. You see what I am getting at: Even though the absolute number of luxury rooms in construction is small, the relative impact on the luxury scale could be material.

For the other classes I divide the “percent of existing” by two, assuming that the hotels will open over the next two years, and you see that the growth rates continue to tell the same story. Upscale branded properties will see a lot of influx, but that is not different from the 4% supply increases over the last few years. Economy hotels are not seeing much competition on the horizon, but that is not really a fair statement since a lot of the competition comes from reflagged properties and in this chart we only look at new-builds. But one takeaway could be that if you have a brand-new economy branded hotel, you may have a competitive advantage.

2020 U.S. hotel forecast slightly upgraded; full recovery still unlikely until 2024

No Byline 12 November 2020 STR Reports

With leisure demand stronger than anticipated in the fall, STR and Tourism Economics slightly upgraded the final 2020 U.S. hotel forecast just released during the virtual NYU Hospitality Conference. Regardless of the short-term upgrade, the forecast for 2021 remains functionally unchanged and full recovery in revenue per available room (RevPAR) is unlikely until 2024.

“Even with the encouraging vaccine news of this week, this pandemic and the subsequent economic impact will continue to limit hotel demand generators into the second half of next year,” said Amanda Hite, president of STR. “Business demand won’t return at a substantial level until caseloads are better contained, and in the meantime, recovery is going to be primarily driven by lower-tier hotels in the leisure-driven markets with outdoor offerings.”

“The economy has entered a slower stage of recovery, and COVID-19 will continue to shape travel conditions in coming quarters,” said Adam Sacks, president of Tourism Economics. “Assuming substantial progress is made against the virus in the first half of 2021, we anticipate travel demand will rebound strongly in the second half.”

STR and Tourism Economics project the industry will recapture 80% of demand by the end of 2021, although RevPAR will be 34.2% lower than in 2019. Average daily rate (ADR) and revenue will follow a slower recovery timeline, putting the industry on pace for full demand recovery at the end of 2023 and a return to pre-pandemic RevPAR levels by the close of 2024.

A note to editors: All references to STR data and analysis should cite “STR” as the source. Please refrain from citing “STR, Inc.” “Smith Travel Research” or “STR Global” in sourcing as those names no longer fit within the STR brand.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base with direct access to the most comprehensive set of historic and forecast travel data available. And our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models.